Home Purchase Process: What To Expect When Purchasing

Purchasing a home can be an intimidating process – it may be the most expensive and emotionally charged purchase of your life. However, with careful research and determination, you can achieve the home of your dreams. This article will help guide you through your journey to homeownership.

Before deciding to buy a house, it is important to think about whether or not it is the right decision for you. Homeownership comes with a lot of responsibilities and costs, so you need to make sure you are ready for it before making the purchase.

The answer to this question largely depends on personal circumstances. A good rule of thumb is to ask yourself how long you plan on staying in the home. If you think you will only live there for a few years, it may make more sense to rent. But if you plan on staying in the home for the long haul, buying might be a better investment. Equity gained over time is a powerful savings tool, but hopping around after the expense of tailoring the space to your particular taste/use can lead to significant expense.

There are pros and cons to both renting and buying a home, so it really depends on what your priorities are and what you’re looking for in a housing situation. If you’re not ready to commit to a long-term investment or you’re not sure you’ll be staying in one place for very long, then renting might be the better option. On the other hand, if you’re looking for stability and a place to call your own, then buying might be a better fit. Ultimately, it’s up to you to decide what’s best for you.

Ask yourself the following questions:

-How much can you afford to spend?

-Where do you want to live?

-What kind of home do you want?

-Do you need a real estate agent?

-What are your next steps?

How long do you plan on living in your current home? If you don’t plan on staying for more than a couple of years, it’s probably better to rent.

How much house can you afford? It may be worth renting if you cannot afford a big enough house for your family a few years down the road. Save up while you’re at it.

There are a lot of homes on the market, so if you can’t find one you like, it’s probably not worth it to buy one you’re not happy with.

You should also keep in mind that the current housing market is very competitive, with high prices and low inventory.

When buying a home, you should be prepared to make multiple offers. You may need to pay more than the listed price to get your offer approved.

If you’re trying to decide whether it’s better for you to buy or rent a home, The Times has a calculator that can help you compare the costs. If it looks like buying would be more expensive, you might want to reconsider your lifestyle. If the numbers show that buying would be cheaper, the next step is to figure out how much house you can afford.

Then, use a mortgage calculator to see how much house you can afford based on your monthly budget and the current interest rates. Keep in mind that you will also need to factor in closing costs, which can be around 2% to 5% of the loan amount.

Homeownership became much more affordable than ever during the pandemic. Interest rates on mortgages were near record-lows, around 3 percent. Since, however, the rates have dramatically increased. You should make an appointment with your chosen banker to see what rates are (currently) and determine how much you can safely afford. Once you have a better picture of your spending habits, you can determine how much you want to allocate toward a monthly home payment. This figure should include your principal, interest, tax and insurance payment, which add up to your monthly mortgage sum.

According to the Federal Housing Administration, many lenders recommend allocating no more than 31 percent of your monthly income to your housing payment. This figure will change based on your amount of debt. Buyers with no other debt may be able to budget as much as 40 percent of their monthly income for housing. However, it is important to remember that the rest of your budget is going to have to go toward essentials such as heat, water, electricity, routine home maintenance and food. In general, your total debt-to-income ratio, including car payments and credit card bills, should not exceed 43 percent.

To calculate what your monthly mortgage payment could be, you’ll need to know your annual gross income, your monthly gross income, and the amount of debt you have. Our mortgage calculator can help you determine what your monthly mortgage may be.

In addition to your mortgage, when you buy a home there are other one-time payments that can quickly add up. These include closing costs, legal fees, and other expenses associated with buying, such as a house inspection or moving fees. Home improvements can also be expensive, so be sure to factor those in when budgeting for your new home.

The pandemic has increased the financial stakes for new homeowners: Because the housing market is so competitive, many buyers are now choosing to waive contingencies in order to have their offers accepted. Contingencies offer buyers an out if something unforeseen arises, such as the need for significant home repairs being found by an inspector, or the home value is significantly less than the purchase price according to an independent home appraiser. A mortgage contingency gives buyers the option of pulling out of the deal if they can’t obtain financing within a reasonable amount of time. And if you need to sell your current home to afford the new one, you should make your offer contingent on the sale of your own home.

When buyers waive their contingencies, they are essentially taking on more risk. While this may give them an advantage in the purchasing process, they may also be subject to additional costs after the sale is finalized. It is important to proceed with caution if you are considering waiving any contingencies.

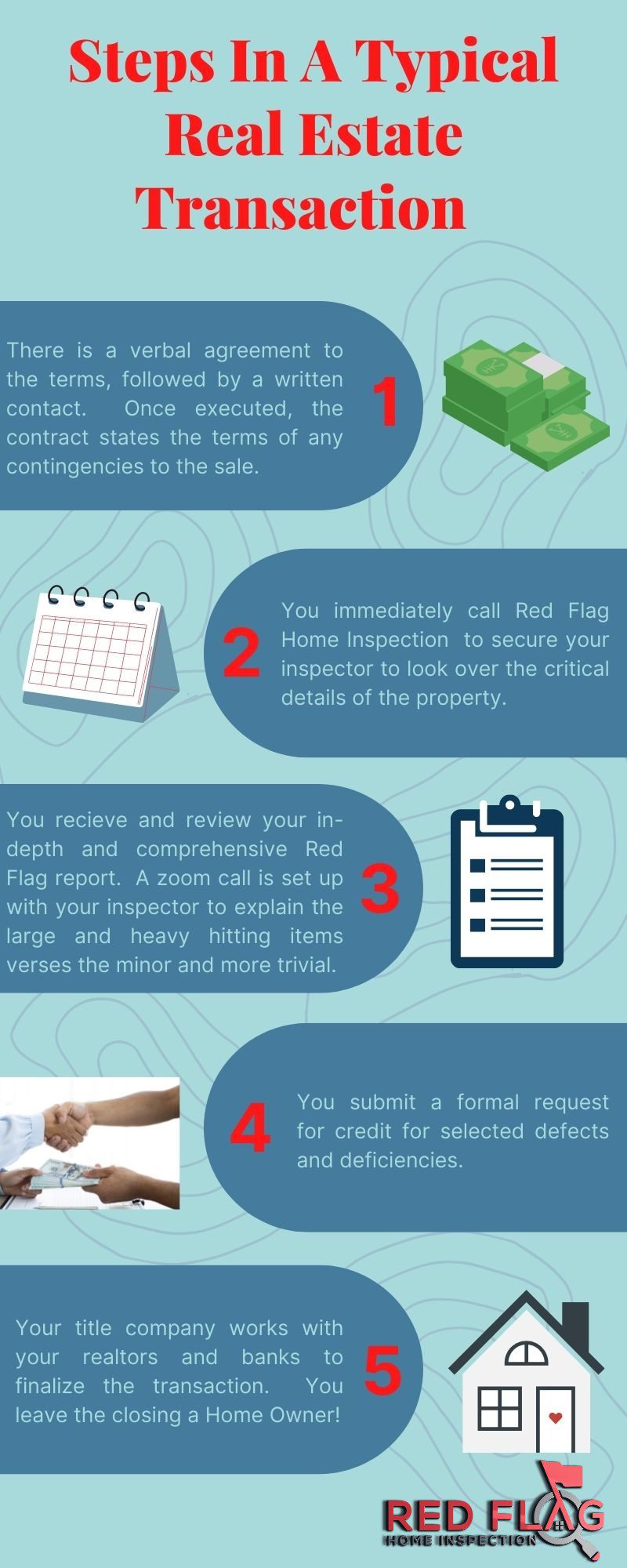

Allow Red Flag Home Inspection to guide you through this hectic time, alongside your chosen realtor. We will inspect in accordance or exceeding the Standards of Practice, so you can relax and enjoy the excitement.

To see other services offered, please review our robust service offerings anytime. Call or email with any questions you may have. Curious how much Tampa Bay’s BEST Inspection Services cost? You can check it out HERE anytime.

Whether a single-family home, a condo, a duplex, a townhouse, or anything in between…….Red Flag Home Inspection has you covered.